Avoid Opening Too Many New Accounts.

Opening multiple new credit accounts within a short period may raise concerns for lenders, affecting your credit score. Only apply for credit when necessary and be mindful of the potential impact.

Opening multiple new credit accounts within a short period of time can have a negative impact on your credit score. Lenders may view this as a red flag and it may raise concerns about your financial stability and ability to repay your debts.

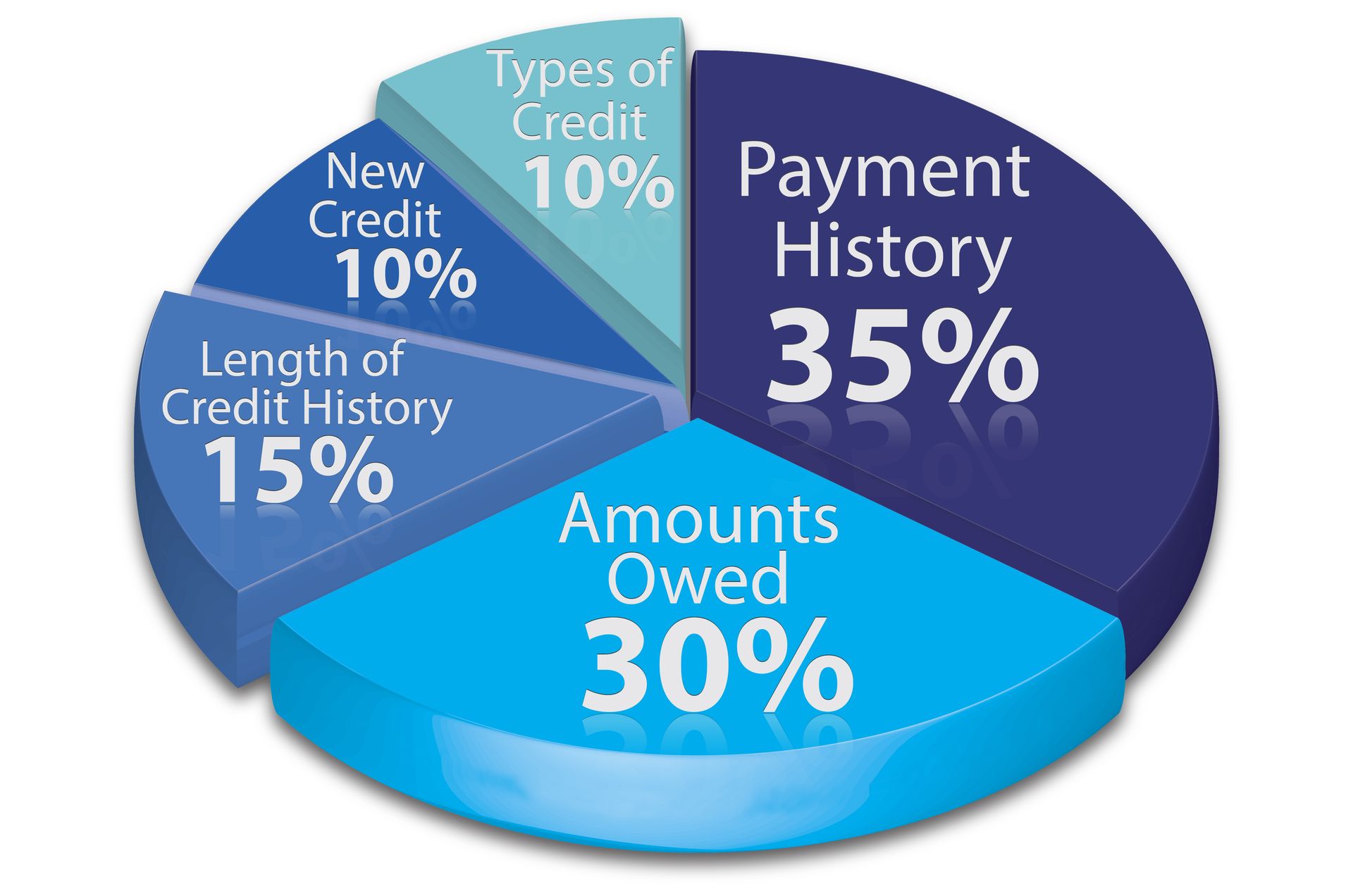

MOne of the main reasons why opening multiple new accounts can affect your credit score is because it can lower the average age of your credit history. Lenders prefer to see a longer credit history, as it provides them with more information about your financial habits and responsible borrowing behavior. When you open several new accounts within a short period, it can significantly decrease the average age of your credit history, potentially leading to a lower credit score.

Additionally, each time you apply for credit, a hard inquiry is made on your credit report. These inquiries remain on your credit report for two years and too many inquiries within a short time frame can signal to lenders that you are seeking credit for desperate reasons. This could raise concerns about your financial stability and may result in a lower credit score.

To avoid this potential negative impact, it is important to only apply for credit when necessary. Before applying for a new credit account, consider whether you genuinely need it and if it aligns with your overall financial goals. Applying for credit impulsively or for unnecessary reasons can have consequences on your credit score.

If you do need to open a new credit account, try spacing out your applications over a longer period of time. This allows your credit history to remain stable and minimizes the negative impact on your credit score. It is also advisable to monitor your credit report regularly to ensure that all the information is accurate and up to date.

In conclusion, opening multiple new credit accounts within a short period can raise concerns for lenders and affect your credit score. It is important to apply for credit only when necessary and be mindful of the potential impact on your credit history. By practicing responsible credit management and avoiding unnecessary new accounts, you can maintain a healthy credit score and financial stability.